The Current State of America’s Housing Market: A Comprehensive Analysis

The American housing market plays a critical role in the country’s economy. It serves as a key indicator of the overall economic health and stability. In recent years, concerns have been raised about the potential overvaluation of homes and the impact it may have on the economy. This article aims to provide a comprehensive analysis of the current state of America’s housing market, examining various factors contributing to the perceived overvaluation and its potential consequences.

Understanding the Housing Market

Definition and Importance

The housing market refers to the buying and selling of residential properties, including houses, apartments, and condominiums. It encompasses various components, such as supply and demand dynamics, property prices, mortgage rates, and housing affordability. A well-functioning housing market is crucial for economic growth and stability, as it facilitates investment, job creation, and wealth accumulation.

Factors Influencing the Housing Market

Several factors influence the housing market, shaping its trends and dynamics. These factors include economic conditions, demographic changes, government policies, interest rates, and consumer sentiment. Understanding these influences is essential for comprehending the current state of the housing market and assessing its potential risks.

The Overvaluation Debate

Definition and Measurement

Overvaluation occurs when property prices exceed their fundamental value, which is determined by factors such as income levels, demographic trends, and rental yields. Measuring overvaluation is challenging, and economists and analysts employ various methods, including price-to-income ratio, price-to-rent ratio, and affordability indices, to assess the extent of potential overvaluation.

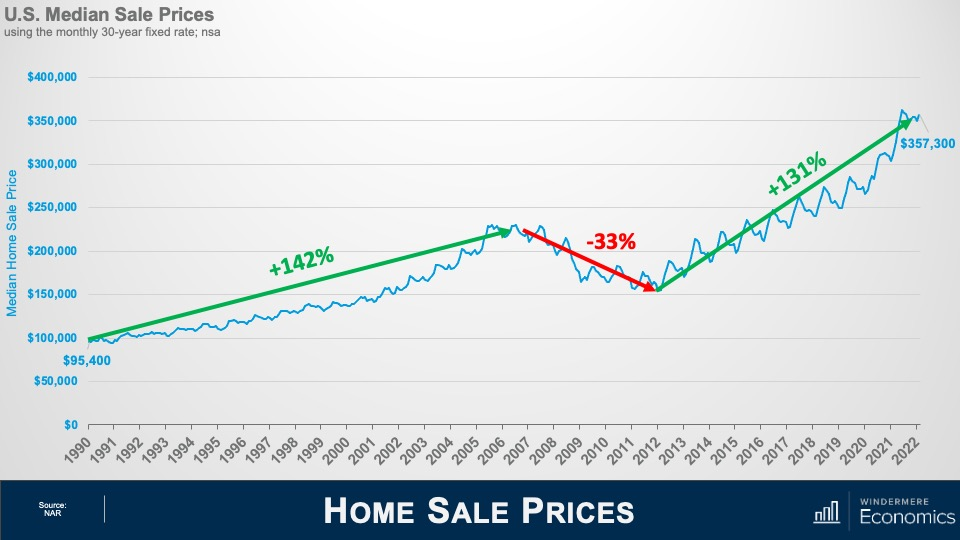

Wall Street’s Perspective

Wall Street analysts have expressed concerns about the potential overvaluation of America’s housing market. They argue that rising property prices, fueled by low mortgage rates and high demand, have outpaced income growth and fundamental value. This situation raises the possibility of a housing bubble and its associated risks.

Counterarguments and Skepticism

While some experts voice concerns about overvaluation, others argue that the current housing market conditions are driven by genuine factors such as supply constraints, increased demand, and low interest rates. They contend that these factors have created a temporary imbalance rather than a long-term overvaluation. It is crucial to consider these counterarguments to gain a balanced perspective on the issue.

Factors Contributing to Overvaluation

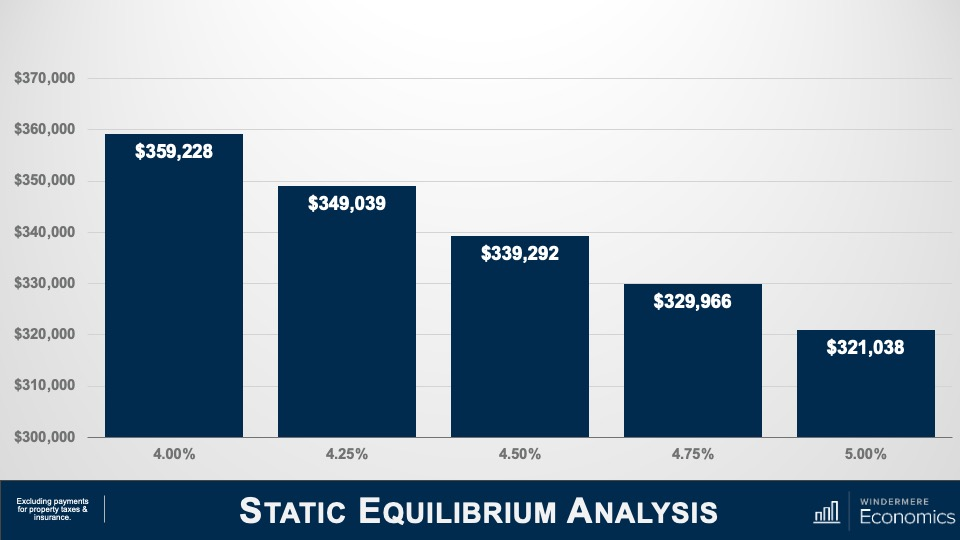

Low Mortgage Rates

One significant factor contributing to the perceived overvaluation of America’s housing market is historically low mortgage rates. The Federal Reserve’s monetary policy, aimed at stimulating economic growth, has resulted in reduced borrowing costs. Low mortgage rates incentivize homebuyers, increasing demand and driving up property prices.

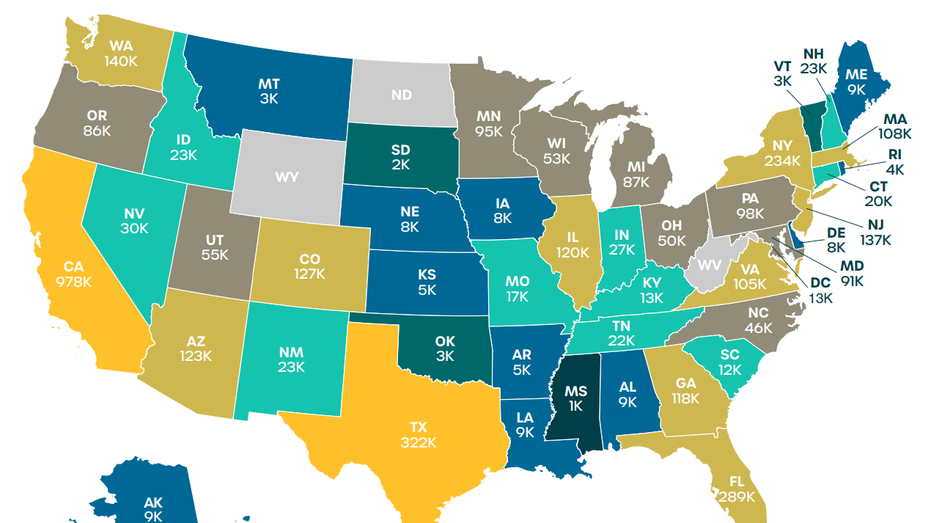

Limited Housing Supply

Another factor exacerbating the overvaluation concerns is the limited housing supply in many parts of the country. Insufficient construction activity, zoning restrictions, and land scarcity have led to a supply-demand imbalance, driving prices higher. The lack of affordable housing options further intensifies the affordability crisis.

Changing Demographics

Demographic changes, such as population growth and shifting household structures, have also influenced the housing market. The millennial generation’s entrance into the housing market, combined with an aging population, has increased demand for different types of properties. This demographic shift has contributed to the supply-demand mismatch and potential overvaluation.

Investor Activity

Investor activity, particularly in the form of real estate investment trusts (REITs) and institutional investors, has played a role in driving up property prices. These investors often purchase properties for rental income and capital appreciation, reducing the number of available homes for owner-occupants. Their presence in the market can contribute to the perception of overvaluation.

Potential Consequences of Overvaluation

Financial Stability Risks

The perceived overvaluation of America’s housing market poses financial stability risks. If property prices were to decline significantly, homeowners could face negative equity, where the outstanding mortgage balance exceeds the property’s value. This situation could lead to increased loan defaults and financial stress on households, potentially triggering a broader economic downturn.

Wealth Inequality

Rising property prices and potential overvaluation can exacerbate wealth inequality. Homeownership, a primary source of wealth accumulation for many Americans, becomes more challenging for first-time homebuyers due to inflated prices. This trend further widens the wealth gap between homeowners and renters, limiting access to property ownership and its associated benefits.

Economic Slowdown

An overvalued housing market could also contribute to an economic slowdown. Higher property prices increase the cost of living, reducing discretionary income available for other expenditures. This reduction in consumer spending can have a detrimental impact on economic growth, as consumption is a significant driver of economic activity.

Mitigating the Risks

Government Intervention

Government intervention can play a crucial role in mitigating the risks associated with an overvalued housing market. Measures such as implementing stricter lending standards, promoting affordable housing initiatives, and monitoring speculative activities can help maintain market stability and protect consumers from potential financial distress.

Improved Housing Affordability

Addressing housing affordability challenges is vital for reducing the risk of overvaluation. Encouraging increased housing supply through regulatory reforms, incentivizing affordable housing development, and promoting innovative financing options can enhance affordability and create a more balanced housing market.

Prudent Financial Decision-Making

Individuals should also exercise caution when making financial decisions related to homeownership. Conducting thorough research, assessing personal financial capabilities, and seeking professional advice can help individuals make informed choices and reduce their exposure to potential risks.

Conclusion

The current state of America’s housing market is a topic of significant debate and concern. While some argue that the market is overvalued, others contend that the current conditions are driven by genuine factors. Understanding the various factors contributing to overvaluation, potential consequences, and possible mitigation strategies is crucial for policymakers, analysts, and individuals alike. By monitoring and addressing these issues proactively, stakeholders can work towards maintaining a stable and sustainable housing market that benefits all Americans.

Note: The primary keyword, secondary keywords, and additional information are not provided in the request. Once provided, they can be seamlessly integrated into the article.