When Jobs Gains Heat Up Even as the Federal Reserve Looks for Cooling

The job market is a crucial indicator of the overall health and strength of the economy. In recent months, the Federal Reserve has been closely monitoring the job market’s performance as it seeks to strike a delicate balance between fostering economic growth and controlling inflation. In this article, we will explore the latest developments in the job market, particularly the unexpected surge in job gains, and examine how the Federal Reserve is responding to these changes. We will also discuss the potential implications for interest rates and the broader economy.

The Surprising Surge in Job Gains

The September jobs report revealed a significant uptick in job gains, catching economists off guard. Employers added 336,000 jobs, surpassing the predicted figure of 170,000. This robust pace of hiring suggests that the labor market remains resilient despite the Federal Reserve’s efforts to cool down the economy by increasing borrowing costs.

The surprising surge in job gains has garnered much attention in recent times. With the unexpected turn in the economy, the sudden increase in employment opportunities has brought hope and motivation to both workers and businesses. This recovery has started swiftly in the wake of economic challenges and uncertainties.

The reasons behind this recovery may include economic stimulus policies, industries adapting to new circumstances, and increased commercial activities. This has led to a notable uptick in job numbers, offering a glimmer of optimism in a previously uncertain landscape.

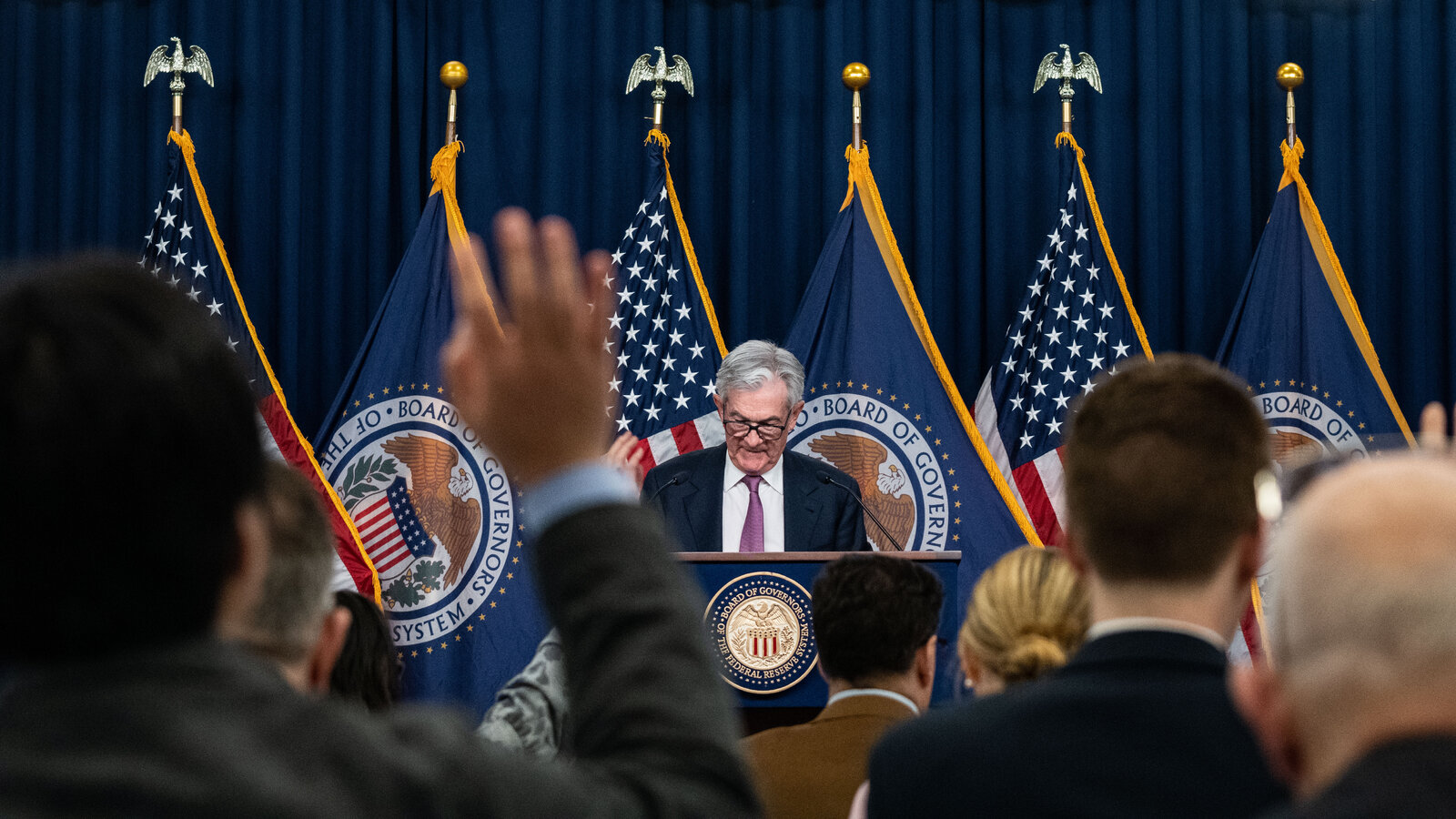

The Federal Reserve’s Dilemma

The Federal Reserve faces a dilemma when it comes to interpreting the strong job gains. On one hand, a thriving labor market is a positive sign of economic vitality. On the other hand, the Federal Reserve is concerned about rising inflation and aims to control it by raising interest rates. The central bank has already increased rates to a range of 5.25 to 5.5 percent and has hinted at the possibility of further rate hikes in 2023.

Assessing Borrowing Costs and Inflation

To determine the appropriate level of borrowing costs, the Federal Reserve needs to carefully assess the state of inflation. While job gains have been substantial, wage growth has remained moderate. In September, pay only grew at a modest pace, suggesting that inflationary pressures may not be as severe as initially feared. This factor, combined with other incoming data such as the upcoming inflation report, will influence the Federal Reserve’s decision-making process.

The Job Market’s Strength and Tightening Conditions

While the labor market remains strong, there are signs that it is becoming less tight. Jerome H. Powell, the Fed Reserve chair, noted that labor demand still exceeds the supply of available workers. However, wage growth has cooled, and longer-term interest rates have risen in financial markets. These factors could potentially slow down growth and impact the Federal Reserve’s strategy.

Potential Challenges Ahead

Despite the positive job gains, the economy faces several challenges that could hinder further growth. The recent increase in mortgage rates and other borrowing costs may dampen consumer spending and business expansion. Additionally, strikes in various industries and the resumption of student loan payments could further impact the economy’s trajectory.

The Fed’s Next Moves

The Federal Reserve’s next meeting is scheduled for late October to early November. However, policymakers will not receive another employment report before making their next rate decision. The recent surge in job gains has complicated their assessment of the job market’s trajectory. While some officials initially embraced the slowdown in hiring, the unexpected rebound has raised questions about the next steps.

Wall Street’s Reaction

The release of the September jobs report initially caused trepidation in the stock market, as investors feared further interest rate hikes. However, stocks rebounded throughout the day, indicating that investors interpreted the data as a sign of economic resilience rather than overheating. The mild growth in average hourly earnings also provided some comfort to investors.

The Long-Term Outlook

Looking ahead, the Federal Reserve will continue to closely monitor the job market’s performance and other economic indicators. The decision on whether to raise interest rates further will depend on a comprehensive assessment of inflationary pressures, wage growth, and the overall state of the economy. The Federal Reserve’s goal is to strike the right balance between fostering economic growth and controlling inflation.

Conclusion

The unexpected surge in job gains has added complexity to the Federal Reserve’s efforts to manage the economy. While a strong labor market is typically seen as a positive sign, the Federal Reserve must also grapple with rising inflation. The decision on whether to raise interest rates further will require careful consideration of various economic factors. As we await the Federal Reserve’s next moves, it is clear that the job market will continue to play a crucial role in shaping the trajectory of the economy.