Image Source: Unsplash

In today’s economic landscape, Canadians are not only grappling with the pressures of inflation and rising interest rates but also experiencing the adverse effects on their mental health. As personal finances become a major concern, individuals are finding themselves burdened by debt, leading to social anxiety and stress. This article delves into the repercussions of financial struggles on Canadians’ mental well-being and explores the underlying factors contributing to these challenges. Let’s explore The Impact of Personal Finances on Canadians’ Mental Health.

The Growing Burden of Debt Payments

Amidst the backdrop of rising interest rates, a significant portion of Canadians find themselves paying more towards their monthly debt obligations compared to previous years. According to a recent Ipsos poll, approximately one-third of Canadians (34%) reported an increase in their debt payments over the past year. Of this group, a notable 17% are paying over $200 more each month. This trend is particularly prevalent among individuals with an income of $60,000 or greater and those aged between 35 and 54.

Interestingly, the survey also revealed that individuals lacking a solid understanding of interest rate increases and their impact on personal finances were less likely to have debt (37%) compared to those who were aware (29%). This suggests that financial literacy plays a crucial role in managing debt and making informed decisions.

Inflation’s Toll on Social Life and Mental Well-being

The effects of inflation and high-interest rates extend beyond financial strain, permeating into various aspects of Canadians’ lives. Many individuals are opting to stay home more often (51%) and reduce socializing (35%) or spending time with friends to save money (30%). This phenomenon, known as “inflation isolation,” has led to feelings of social isolation (20%) and loneliness (19%) among one in five Canadians.

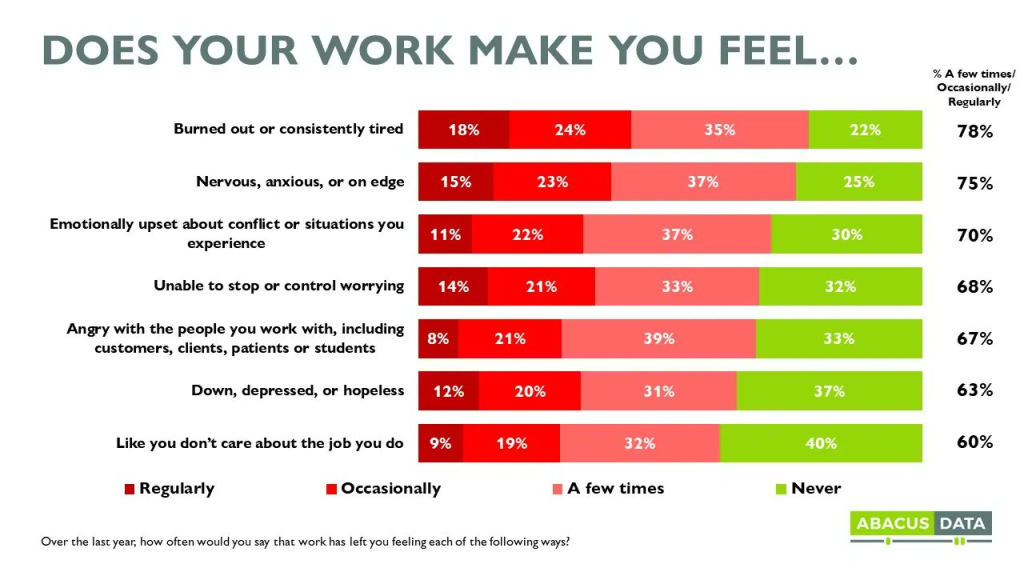

Moreover, the current economic conditions have sparked increased stress (42%) and anxiety (39%) among four in ten individuals. Younger Canadians and females, in particular, are significantly more likely to experience heightened stress and anxiety due to the economic situation. On the other hand, males are more inclined to believe that inflation and interest rates have no impact on their lives.

The impact of financial struggles on social interactions is evident, with younger Canadians and those with lower incomes spending less time socializing and with friends. This reduction in social connections directly contributes to their increased sense of social isolation and loneliness.

Mental Health Consequences of Personal Debt

The negative impact of personal debt on mental health becomes more pronounced among individuals who rate their debt as terrible. This group is significantly more likely to experience elevated stress (77%), anxiety (72%), and choose to stay home more often (72%). Additionally, they are more prone to spending less time socializing (55%) or with family (33%) in an effort to save money. Comparatively, those who rate their personal debt as excellent do not exhibit these intensified mental health consequences.

The repercussions of debt are also felt by individuals who regret the amount of debt they have taken on, those concerned about the effects of rising interest rates, and those currently worried about their debt levels. These individuals are more likely to experience increased stress, anxiety, and limitations on their social activities.

About the Study

The findings discussed in this article stem from a comprehensive Ipsos poll conducted between September 5-8, 2023, on behalf of MNP LTD. The survey involved interviewing a sample of 2,000 Canadians aged 18 and over. To ensure the sample’s composition reflected that of the adult population according to Census data, weighting techniques were employed. The credibility interval for this poll is ±2.5 percentage points, with a confidence level of 95%.

For more detailed information on the MNP Consumer Debt Index, please visit mnpdebt.ca/CDI.

Conclusion

The intersection of personal finances and mental health presents a complex challenge for Canadians. As inflation and interest rates continue to impact individuals’ economic circumstances, the toll on mental well-being becomes increasingly evident. The burden of debt payments, combined with reduced social interactions and feelings of isolation, contribute to heightened stress and anxiety. It is crucial for individuals to prioritize financial literacy and seek support in managing their debt to mitigate the mental health consequences associated with financial struggles.

As the economic landscape evolves, it is essential for policymakers, financial institutions, and individuals themselves to recognize the interconnectedness of personal finances and mental health. By addressing these issues holistically and promoting financial literacy, Canadians can strive for a healthier balance between their financial well-being and mental well-being.